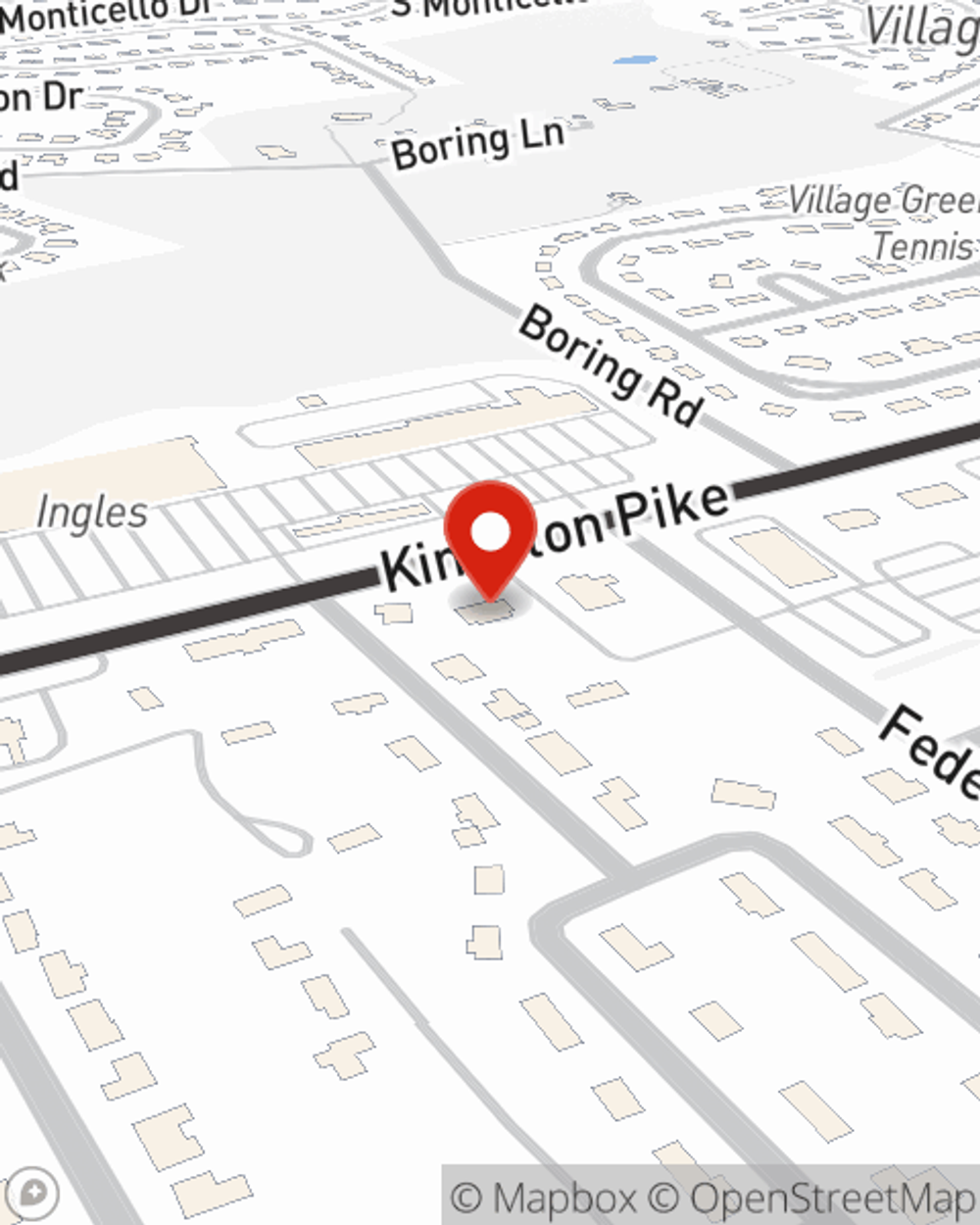

Renters Insurance in and around Knoxville

Renters of Knoxville, State Farm can cover you

Your belongings say p-lease and thank you to renters insurance

Would you like to create a personalized renters quote?

- Farragut

- Tennessee

- Knox County

- Anderson County

- Blount County

- Maryville

- Alcoa

- Oak Ridge

- Strawberry Plains

- Lenoir City

- Loudon

- Vonore

- Loudon County

There’s No Place Like Home

There are plenty of choices for renters insurance in Knoxville. Sorting through savings options and coverage options to pick the right one is a lot to deal with. But if you want budget-friendly renters insurance, choose State Farm for covering all of your belongings and personal items. Your friends and neighbors enjoy remarkable value and straightforward service by working with State Farm Agent Josh Ellis. That’s because Josh Ellis can walk you through the whole insurance process, step by step, to help ensure you have coverage for everything you own inside your rental, including clothing, souvenirs, sports equipment, furnishings, and more! Renters coverage like this is what sets State Farm apart from the rest. Agent Josh Ellis can be there to help whenever trouble knocks on your door, to help you submit your claim. State Farm provides you with insurance protection and is here to help!

Renters of Knoxville, State Farm can cover you

Your belongings say p-lease and thank you to renters insurance

There's No Place Like Home

Renters insurance may seem like the least of your concerns, and you're wondering if having it is actually beneficial. But imagine the cost of replacing all the personal property in your rented apartment. State Farm's Renters insurance can help when fires or break-ins damage your stuff.

State Farm is a value-driven provider of renters insurance in your neighborhood, Knoxville. Visit agent Josh Ellis today for a free quote on a renters policy!

Have More Questions About Renters Insurance?

Call Josh at (865) 223-5461 or visit our FAQ page.

Simple Insights®

Signing a lease: What you need to know

Signing a lease: What you need to know

When signing a lease, it’s important to prepare, understand your lease agreement, and ask the right questions of your landlord.

Before you rent, ask your landlord about move-costs and monthly bills due

Before you rent, ask your landlord about move-costs and monthly bills due

Rent, deposits and fees can sometimes get tricky if they haven't been discussed thoroughly with your landlord before signing a rental agreement.

Simple Insights®

Signing a lease: What you need to know

Signing a lease: What you need to know

When signing a lease, it’s important to prepare, understand your lease agreement, and ask the right questions of your landlord.

Before you rent, ask your landlord about move-costs and monthly bills due

Before you rent, ask your landlord about move-costs and monthly bills due

Rent, deposits and fees can sometimes get tricky if they haven't been discussed thoroughly with your landlord before signing a rental agreement.